41+ is mortgage insurance deductible in 2021

You can deduct up to 10000 per year in paid property taxes if youre single. Web Mortgage Insurance Premium Deduction Extended.

Intouch Jan Feb16 By Into Issuu

The recently signed Consolidated Appropriations Act 2021 includes a one-year.

. 1690 Age 61 to 70. Web The tax deduction for PMI premiums or Mortgage Insurance Premiums MIP for FHA-backed loans is not part of the tax code but since the financial crisis has generally been authorized by Congress as parts of other bills and extended to cover the most recent tax year. With all of the media publishing articles about the tax reform it is.

The deduction begins to phase out at an AGI amount of 100000 and phases out completely once AGI reaches 109000. 5640 The limit on premiums is for each person. Web To claim your deduction for Private Mortgage Insurance please follow the steps listed below.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web To enter your qualifying mortgage insurance premiums as an Itemized Deduction. Web Yes home mortgage insurance is tax deductible for the 2021 tax year.

The itemized deduction for mortgage insurance premiums has expired and you can no longer claim the deduction for tax. If married filing separately the phaseout begins at. Web If youre single filing as head of household or married and filing jointly the deduction begins phasing out by 10 for each 1000 by which your adjusted gross.

Web Many home buyers are wondering if private mortgage insurance or PMI is still tax deductible in 2022. Web Can I deduct private mortgage insurance PMI or MIP. Thats the case for tax year 2021 but this may change in the future.

Ad Calculate Your Payment with 0 Down. Web 2021 Mortgage Insurance Premium Deductibility3 Traditionally homeowners who itemize their tax deductions have been able to deduct the interest paid on their. Get Instantly Matched With Your Ideal Mortgage Lender.

850 Age 51 to 60. As a homeowner you have the choice between taking a standard deduction or itemizing. 450 Age 41 to 50.

SOLVED by TurboTax 5787 Updated 2 weeks ago. Be aware of the phaseout limits however. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction.

Lock Your Rate Today. Web The mortgage insurance premium deduction phases out once your adjusted gross income AGI is more than 100000 whether youre married or single. From within your TaxAct return Online or Desktop click Federal on smaller devices click in.

Ad 10 Best Home Loan Lenders Compared Reviewed. Comparisons Trusted by 55000000. Age 40 or under.

The election to deduct qualified mortgage in-surance premiums you paid under a mortgage insurance contract issued after December 31. Youre able to deduct up to 5000 each if youre married filing separately or. Web Mortgage insurance premium.

4520 Age 71 and over. Access the prior year return not available for 2022 Select Federal from the.

Mortgage Insurance Paid Upfront The New York Times

Is Private Mortgage Insurance Pmi Tax Deductible

Is Pmi Tax Deductible Credit Karma

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Are Mortgage Insurance Premiums Deductible In 2022

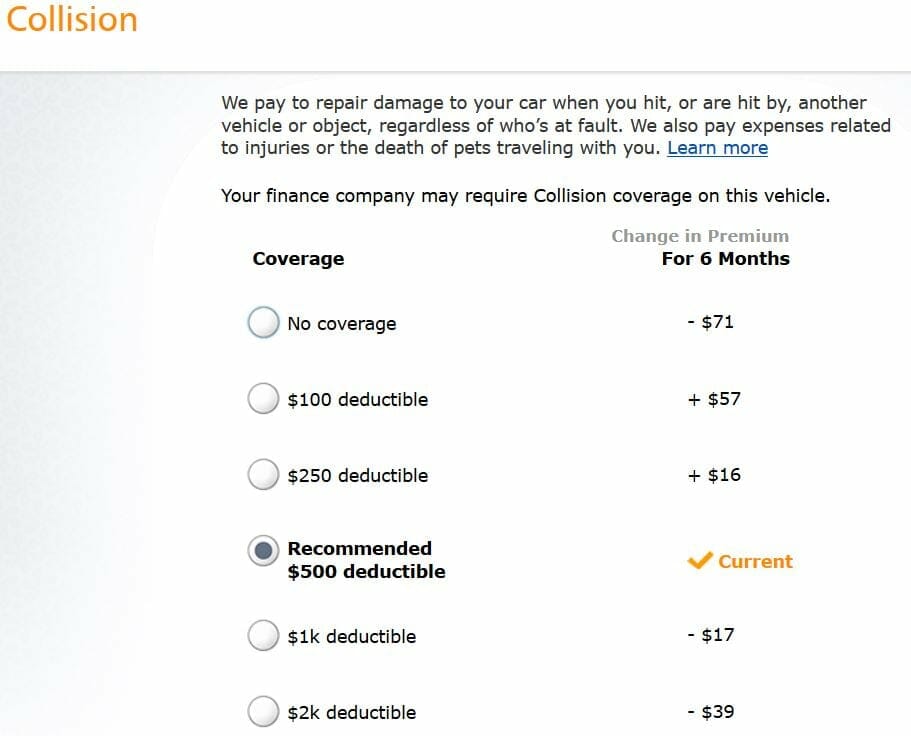

How Much Can You Save By Raising Your Auto Insurance Deductible The Dough Roller

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Filing Taxes Mortgage Insurance Premium Tax Deduction Has Expired

Is Mortgage Insurance Tax Deductible Bankrate

5 Types Of Private Mortgage Insurance Pmi

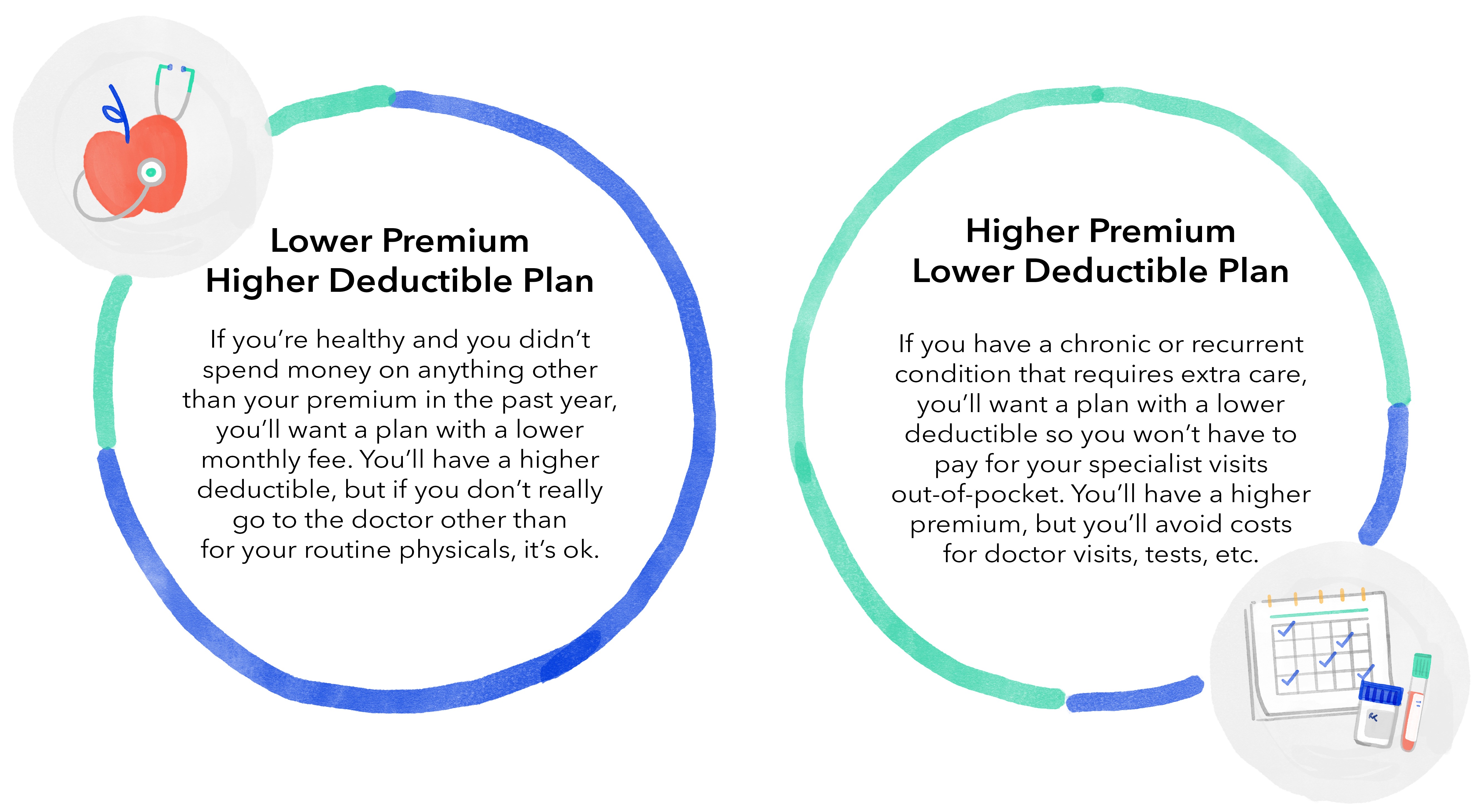

Insider Hacks That Can Save You Money On Health Insurance

285 Hustler 122922 By Colorado Community Media Issuu

Drs A

Pros Cons Of Disaster Mortgage Insurance

What Is A Health Insurance Deductible And How Does It Work

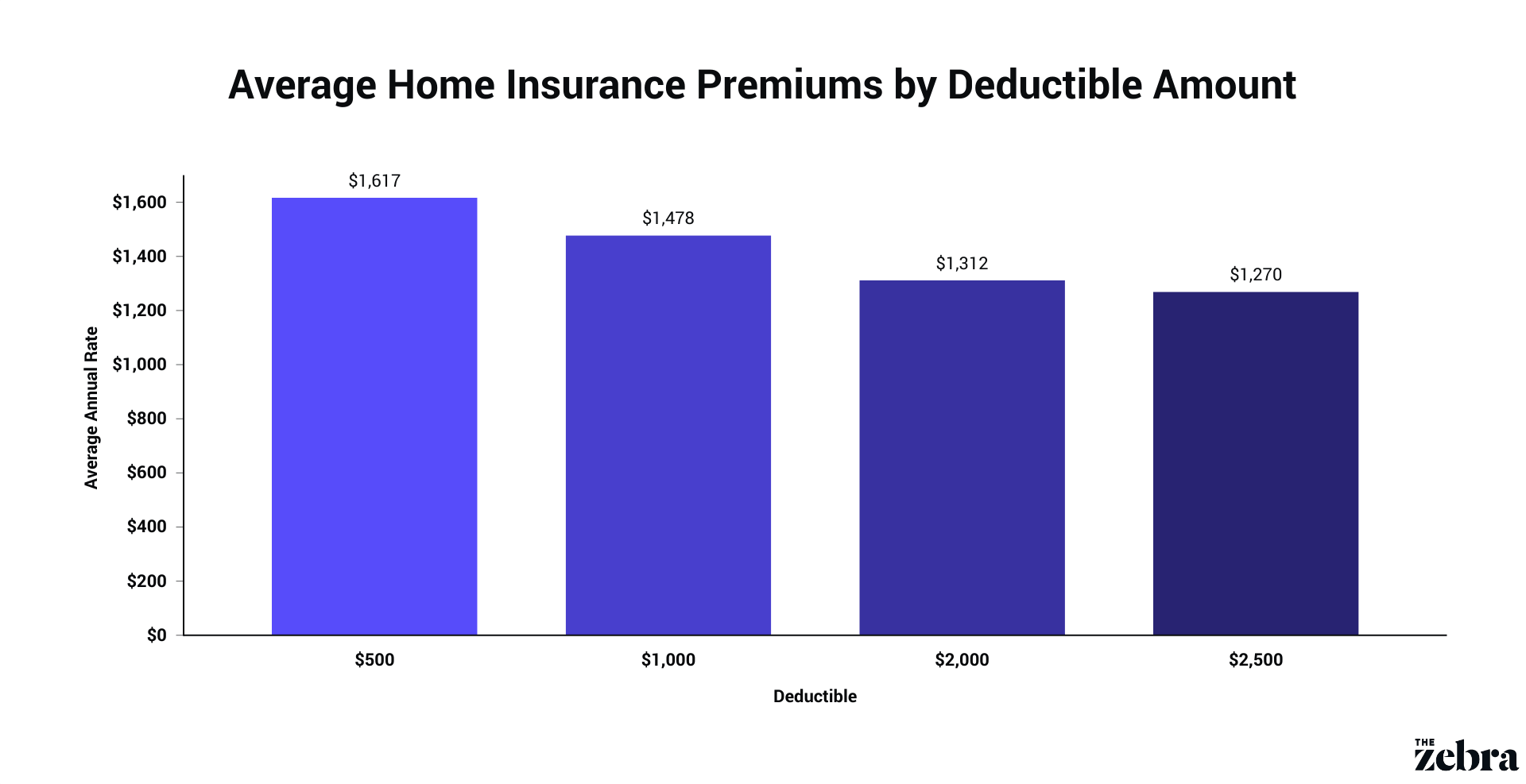

Understanding Home Insurance Deductibles The Zebra